For most of us, money is something we take for granted. We pull it from our wallets, tap our cards, or check our bank accounts online, rarely pausing to consider the long and fascinating journey that brought us to this point. But the story of money – and specifically, paper money – is a tale of innovation, necessity, trust, and even a little bit of magic. It’s a story that spans millennia and continents, beginning not in the bustling financial centers of today, but in the ancient imperial courts of China.

The Seeds of an Idea: China’s Early Experiments

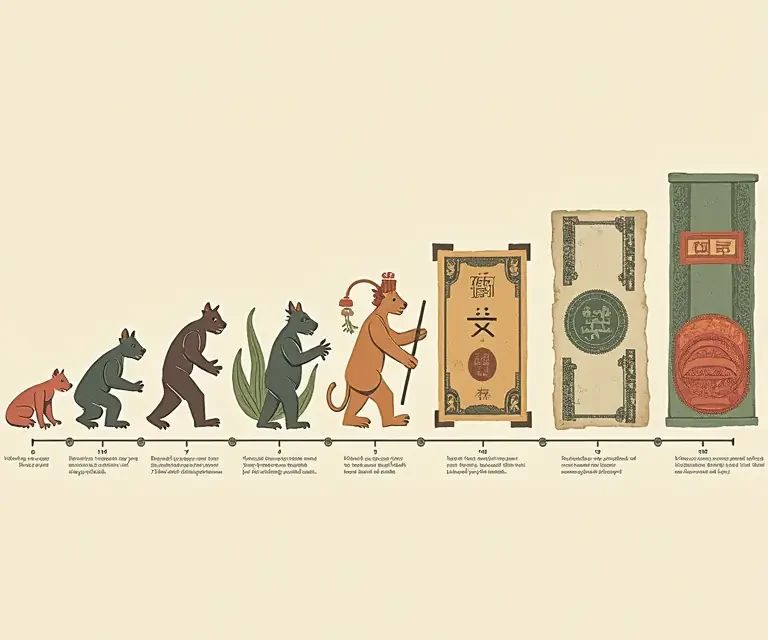

The earliest forms of money weren’t coins or paper at all. They were commodities: things people needed and valued, like cattle, grain, shells, or even tools. But carrying around these goods was cumbersome. That’s where the idea of representative money began to take root. Around the 7th century AD, during the Tang Dynasty, China faced a chronic shortage of copper for minting coins. This scarcity spurred merchants to deposit their coins with trustworthy individuals, who would issue receipts – essentially, promises to pay the depositor back their value.

These receipts, originally intended as temporary substitutes for coins, began to circulate as a form of payment themselves. This was particularly useful for long-distance trade, avoiding the risks and difficulties of transporting heavy metal coinage. By the Song Dynasty (960-1279 AD), this practice had become widespread. The government, recognizing the convenience and economic benefits, began issuing its own paper notes – the world’s first true paper money. These weren’t backed by precious metals initially, but by the full faith and credit of the emperor. It was a bold move, and one that relied heavily on public trust.

Initially, the paper money issued by the Song government was a success. It facilitated trade, boosted the economy, and reduced the logistical challenges of using coinage. However, the Song Dynasty’s experiment wasn’t without its problems. Over time, the government began to issue too much paper money, leading to inflation. This devaluation of the currency ultimately contributed to the dynasty’s economic woes and eventual decline. It’s a cautionary tale about the importance of responsible monetary policy, a lesson that continues to resonate today.

Spreading Westward: From the Silk Road to Europe

The knowledge of paper money didn’t remain confined to China. It traveled westward along the Silk Road, carried by merchants, travelers, and diplomats. Marco Polo, the famous Venetian explorer, was deeply impressed by the paper money system he encountered in 13th-century China. He wrote extensively about it in his travels, describing its convenience and efficiency. However, Europe wasn’t quite ready for the concept.

For centuries, Europe remained largely attached to its system of coinage, often based on gold and silver. There were several reasons for this. A strong tradition of metal-backed currency existed, and trust in paper money was low. Furthermore, the necessary infrastructure – a robust banking system and widespread literacy – wasn’t yet in place. Early attempts to introduce paper money in Europe, such as in Sweden in the 17th century, were met with resistance and ultimately failed. The idea of trusting a piece of paper as a store of value was a difficult one to embrace.

The Rise of Modern Banking and Paper Currency

The turning point came with the development of modern banking in the 17th and 18th centuries. Banks began to issue notes promising to pay depositors on demand. These notes, initially handwritten, gradually evolved into standardized printed banknotes. The Bank of England, founded in 1694, played a crucial role in this process. It began issuing banknotes that were backed by government debt and gold reserves. This backing instilled confidence in the currency and facilitated trade and economic growth.

The 19th century witnessed a rapid expansion of paper money systems across the globe. Governments increasingly took control of banknote issuance, establishing central banks to regulate the money supply and maintain financial stability. The United States, after a period of experimentation with state-chartered banks and various forms of currency, established a national banking system in 1863, introducing a uniform national currency backed by U.S. government bonds. This helped to finance the Civil War and laid the foundation for the modern American financial system. Throughout this period, innovations in printing technology – like the development of intaglio printing – made banknotes more difficult to counterfeit, further enhancing trust in the system. You can see echoes of the importance of secure design in other areas of engineering, such as the intricate geometry of spiderwebs.

The Gold Standard and Its Demise

For much of the 19th and early 20th centuries, many countries operated under the gold standard. This meant that their currencies were directly convertible into gold at a fixed rate. The gold standard provided a degree of stability and predictability to the international monetary system. However, it also had its limitations. It restricted the ability of governments to respond to economic shocks, and it was vulnerable to disruptions during times of war or crisis.

The First World War led to the suspension of the gold standard as countries printed money to finance their war efforts. Attempts to restore the gold standard in the 1920s proved unsuccessful. The Great Depression of the 1930s exposed the inherent weaknesses of the system, and most countries abandoned the gold standard altogether. This marked a significant shift in the history of money, paving the way for the rise of fiat currencies – currencies that are not backed by any physical commodity but are declared legal tender by a government.

The Age of Fiat Currency and Plastic Money

Following the abandonment of the gold standard, fiat currencies became the norm. The value of these currencies is based on public trust and government regulation. Central banks play a vital role in managing inflation and maintaining economic stability. The 20th century also saw the emergence of “plastic money” – credit cards and debit cards. These cards allowed consumers to make purchases on credit or draw directly from their bank accounts, further reducing the need for physical currency.

The development of electronic funds transfer systems, such as Automated Teller Machines (ATMs) and electronic clearinghouses, further accelerated the shift away from cash. ATMs, first introduced in the 1960s, provided convenient access to cash 24/7, while electronic clearinghouses enabled the efficient transfer of funds between banks. These innovations revolutionized the way people manage their money and conduct transactions.

The Digital Revolution: From Online Banking to Cryptocurrencies

The late 20th and early 21st centuries have witnessed a digital revolution in finance. Online banking allows customers to manage their accounts, pay bills, and transfer funds from the comfort of their homes. The rise of e-commerce has created a demand for secure and convenient online payment methods. Companies like PayPal and other payment processors have emerged to fill this need.

More recently, cryptocurrencies like Bitcoin have entered the scene, promising a decentralized and secure alternative to traditional fiat currencies. Cryptocurrencies operate on blockchain technology, a distributed ledger that records transactions in a transparent and immutable manner. While cryptocurrencies are still relatively new and volatile, they have the potential to disrupt the traditional financial system. The underlying technology, however, has many applications beyond just finance. Consider the advanced materials science used in building ancient structures, such as Roman concrete, which also showcases remarkable durability and longevity through innovative design.

Here’s a video exploring the future of finance and technology:

The Future of Money: Digital Wallets and Beyond

The trend toward digital payments is likely to continue. Digital wallets, such as Apple Pay, Google Pay, and Samsung Pay, allow users to store their credit and debit card information on their smartphones and make contactless payments. These wallets offer convenience, security, and speed. Central Bank Digital Currencies (CBDCs) are also being explored by many countries. A CBDC is a digital form of a country’s fiat currency, issued and regulated by its central bank. CBDCs could potentially improve payment efficiency, reduce transaction costs, and enhance financial inclusion.

The evolution of money is far from over. New technologies, such as artificial intelligence and machine learning, are likely to play an increasingly important role in shaping the future of finance. We may see the emergence of new forms of money, new payment systems, and new financial institutions. The key challenge will be to ensure that these innovations are used responsibly and ethically, to create a financial system that is fair, inclusive, and sustainable. The evolution of money mirrors the evolution of many other aspects of human civilization, driven by both practical needs and creative problem-solving – similar to the development of chopsticks across cultures.

The Importance of Trust and Regulation

Throughout the history of money, one thing has remained constant: the importance of trust. Whether it was trust in the emperor who issued the first paper money, trust in the banks that issued banknotes, or trust in the governments that issue fiat currencies, trust is the foundation of any monetary system. Without trust, money loses its value.

Regulation also plays a critical role. Governments and central banks have a responsibility to regulate the financial system to protect consumers, prevent fraud, and maintain financial stability. Effective regulation can foster trust and encourage innovation. However, excessive regulation can stifle innovation and hinder economic growth. Finding the right balance is a constant challenge.

Lessons from the Past

The curious evolution of paper money offers valuable lessons for the present and the future. It teaches us the importance of responsible monetary policy, the need for trust and regulation, and the power of innovation. It also reminds us that money is not simply a technical tool, but a social construct – a reflection of our values, our beliefs, and our collective trust.

The journey from the early paper notes of Imperial China to the digital wallets of today is a testament to human ingenuity and adaptability. As we continue to navigate the ever-changing landscape of finance, it’s crucial to learn from the past and embrace the future with wisdom and foresight. Just as the principles of design influence everything from coin design to architectural marvels, understanding the historical context of money is essential for building a more resilient and equitable financial system. Thinking strategically about systems, even in seemingly unrelated areas like playground games, reveals patterns of human behavior that can inform our understanding of complex systems like finance.

The Curious Acoustics of Historical Echo Chambers: Resonance, Ritual, and Revelation

The Curious Acoustics of Historical Echo Chambers: Resonance, Ritual, and Revelation  The Curious Cartography of Scent: Mapping Perfume Ingredients Through History

The Curious Cartography of Scent: Mapping Perfume Ingredients Through History  The Curious Lexicon of Lost Trades

The Curious Lexicon of Lost Trades  The Surprisingly Consistent Science of Historical Ice Harvesting – A Frozen History of Commerce & Preservation

The Surprisingly Consistent Science of Historical Ice Harvesting – A Frozen History of Commerce & Preservation  The Unexpectedly Consistent Science of Historical Buttonhooks – Fashion, Function & Forgotten Tools

The Unexpectedly Consistent Science of Historical Buttonhooks – Fashion, Function & Forgotten Tools  The Surprisingly Consistent Science of Historical Toy Soldiers – Miniature Warfare, Materials & Collective Play

The Surprisingly Consistent Science of Historical Toy Soldiers – Miniature Warfare, Materials & Collective Play